Gold and Silver

It was really only a sophistication of the basic trading philosopy.

Gold was known and was mined in Europe but was not plentiful. It therefore commanded a high price. Silver however was plentiful and high rates of silver production were possible. On the other hand in the East, particularly in China and Eastern Africa gold was plentiful but silver was scarce, the price differential between the two precious metals was reversed.

The Venetians took advantage of this situation and secured trading arrangements to become the monopoly supplier of Silver to the east and the monopoly supplier of Gold to the West. It was the pursuit of this Trade which took Marco Polo to the East.

The Venetians took advantage of this situation and secured trading arrangements to become the monopoly supplier of Silver to the east and the monopoly supplier of Gold to the West. It was the pursuit of this Trade which took Marco Polo to the East.

The Venetians then protected the extremities of their trade buy making deals with the Mamelukes of Egypt and the Mongols of central Asia to ensure their goods could reach the intended markets and the incoming goods were protected. The wealth they were generating enabled them to take advantage of another opportunity.

Manipulation of price differentials.

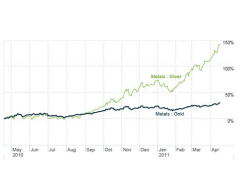

The variations in price between gold and silver still occur today but Venice made the maipulation of the price differential a speciality. They made so much money out of these transactions, ( forty per cent per annum was normal) that they gained the ability to stockpile both gold and silver. Now they had another source of profit. If they stabilised their silver stock, neither buying from the European mines nor selling to the East their near monopoly position meant that silver prices fell in Europe and increased in the East. Conversely if they held on to their stock of gold, neither buying nor selling , the price of gold increased in Europe and fell in the East.

The variations in price between gold and silver still occur today but Venice made the maipulation of the price differential a speciality. They made so much money out of these transactions, ( forty per cent per annum was normal) that they gained the ability to stockpile both gold and silver. Now they had another source of profit. If they stabilised their silver stock, neither buying from the European mines nor selling to the East their near monopoly position meant that silver prices fell in Europe and increased in the East. Conversely if they held on to their stock of gold, neither buying nor selling , the price of gold increased in Europe and fell in the East.

Genoa and Florence

The lessons were not lost on their trading rivals in Genoa and Florence. Genoa saw itself as a direct rival to Venice but was on the wrong side of the Italian peninsula to be as effective as Venice. It learned to mirror the Venetian manoeuvres. by doing so they shared in Venetian wealth, to have ignored the artificial cycles Venice created would have invited financial disaster.

Florence and the financial institutions of Bardi, Peruzzi and Acciaiuoli, became financiers rather than traders but involvement in trade was inevitable. At the time usury, the charging of interest was considered immoral and indeed, in the eyes of the church of Rome a mortal sin. The banks had to be creative.

The Florentines worked with rather than against the Church of Rome. The paid the Church, regularly and on time, the value of the churches tithes from the whole of Europe. They then used their network of agents to collect the actual tithes, which were then used locally to lend to local traders and rulers. They charged the church a commission for performing this task and a percentage for covering the currency fluctuations between the various centres. The result was that they had a regular cash flow in every different denomination of currency in use throughout Europe. Although they were released from the need to actually exchange currencies they charged an exchange fee for every subsequent transaction which otherwise would have required currency exchange.

The Florentines worked with rather than against the Church of Rome. The paid the Church, regularly and on time, the value of the churches tithes from the whole of Europe. They then used their network of agents to collect the actual tithes, which were then used locally to lend to local traders and rulers. They charged the church a commission for performing this task and a percentage for covering the currency fluctuations between the various centres. The result was that they had a regular cash flow in every different denomination of currency in use throughout Europe. Although they were released from the need to actually exchange currencies they charged an exchange fee for every subsequent transaction which otherwise would have required currency exchange.

Florins

Through theirrelation with the papacy, the Florentine banks persuaded the church to release Florence from the use of the silver currency which was in use throughout the Holy Roman Empire. In their status as papal agents they were allowed to issue their own gold coinage, the Florence or Florin. Where the terms of trading activity were valued in Florins no charge for currency exchange was made. In this way the Florin was made the standard currency throughout Europe.

The Florentine banks issued more florins when the price of gold was low and took coins out of circulation when the price of raw gold was high. Their objective was to ensure that the value of their coins was always above the value of raw gold as the coins were gold and an alternative way of releasing their value was to melt them down. The Venetians did not take kindly to this Florentine initiative as it lessened the Venetian control of the market.

Avoidance of usury

Because usury was not allowed, every loan took the banks into the area of trade. When they made advances to King Edward to secure his budgetry requirements, one alternative would have been to copy the Church of Rome model and collect the taxes directly from the lords and barons of the country. Instead they asked for and obtained a share of the wool trade. In theory when the taxes were finally collected the banks could be paid and their share of the wool trade returned to royal control.

Because usury was not allowed, every loan took the banks into the area of trade. When they made advances to King Edward to secure his budgetry requirements, one alternative would have been to copy the Church of Rome model and collect the taxes directly from the lords and barons of the country. Instead they asked for and obtained a share of the wool trade. In theory when the taxes were finally collected the banks could be paid and their share of the wool trade returned to royal control.

This failed to take into account the trading activities of the banks. They bought wool from other traders to a level where they were in control of the market. In an imitation of the Venetian gold and silver manipulations they then stockpiled the wool, thus sending the sale price up and then they stopped buying wool to sending the purchase price down, thus the quantity of wool needed to meet the “service charge” of the Kings dept grew, even though he was repaying the majority of his original loan.

They ended up with total control of the woollen goods trade. The Florentine banks then arbitrarily devalued the value of english currency against their own florin. England was not the only country to suffer. The Franks, Naples and Aragon all suffered similar manipulation. Nor was wool the most important commodity the Florentines monopolised. Their dominance of the markets in grain caused great profits for themselves and hardship for everyone else.

Edward’s action

It was a this point that King Edward made his own arbitrary decision. He cancelled all agreements with both Bardi and Peruzzi, threw their agents out of the country and started a weaving industry in England.

However, in the financial crisis which followed almost immediately, the actions of the Venetians was far more significant than King Edward’s action. The Venetians were jealous of the Florentine success and increasingly concerned about their reduced control of the market in precious metals. They took action. Venetians bought and stockpiled vast quantities of silver and flooded the market with gold. Acting in accordance with their background philosopy as the price of gold dropped the Florentines bought more gold and minted more coins. The Venetians drove the price of gold still lower.

This represented a crisis for the Florentines. In order to stabilise their currency the Florentine banks borrowed heavily to buy back Florins at a time when the price of gold continued to fall. Loss of trading income and loss of control of physical commodities meant that they failed to service their commitments. All three Florentine banks went bankrupt dragging other smaller banks, trading, manufacturing and mining companies with them. At this Point the Venetians tightened the gold supply prices rose. The fate of the majority of the Florentine currency was to be melted down as the value of raw gold was greater than the face value of the currency. A whole financial system was destroyed.

King Edward III may have achieved his aim of breaking the hold of the Florentine banks on his economy, but in 1344 he himself was bankrupt. The years 1347 -1351 brought the Black Death and with it an inability to recover from the financial crisis. One third of the population of Europe died. Whole villages were wiped out. Land and property became worthless.

And yet only five years later in Kind Edward launched an all out attack on the French. Despite it being impossible for him to raise loans, despite difficulties in raising taxation in the aftermath of the Black Death, it is from this date that the wealth of the English treasury, the possession of the “Crown Jewels” originates.

in 1357 “The Treasury” for the kings collection of treasure was established at Corfe Castle in Dorset. Plans were made immediately for a new stronghold attached to the Palace of Westminster. The Jewel Tower was completed in 1366.

in 1357 “The Treasury” for the kings collection of treasure was established at Corfe Castle in Dorset. Plans were made immediately for a new stronghold attached to the Palace of Westminster. The Jewel Tower was completed in 1366.

How on earth did King Edward achieve this? There may have been a world financial crisis but obviously it was not an English Crisis! Where did the treasure come from?